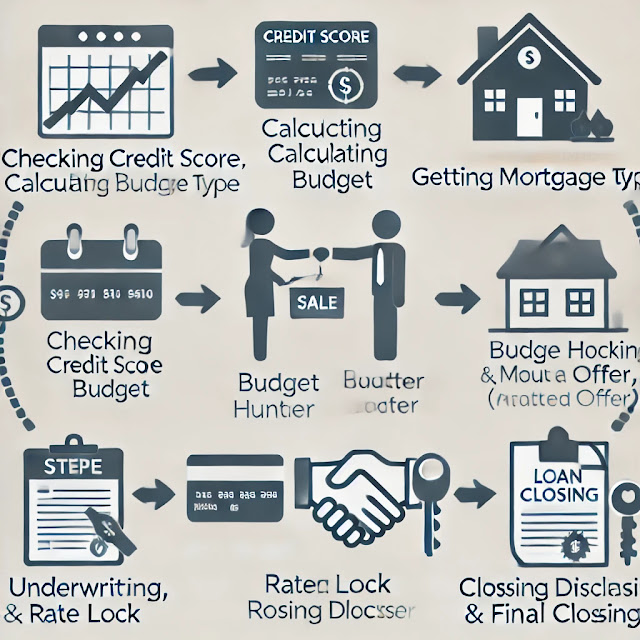

Step 1: Check Your Credit Score

Your credit score impacts the interest rate and loan options you qualify for, so it’s essential to start by checking your score. Aim to have a score of at least 620 for conventional loans or 580 for FHA loans. A score of 740 or higher typically qualifies for the best rates.

How to Improve Your Credit Score:

- Pay down existing debts.

- Avoid opening new credit accounts.

- Make all payments on time.

Step 2: Calculate Your Budget and Down Payment

Determine how much house you can afford, including the down payment, which is typically 3% to 20% of the home price. Many financial experts recommend aiming for 20% to avoid Private Mortgage Insurance (PMI), but some government-backed loans (like FHA or VA loans) have lower or no down payment requirements.

Budget Considerations:

- Housing expenses (target 28% of monthly income).

- Total debt obligations (target 36% of monthly income).

Step 3: Decide on a Mortgage Type

There are several types of mortgages, each with its benefits and requirements:

- Conventional Loan: Ideal for those with good credit and a down payment of at least 3%.

- FHA Loan: For borrowers with lower credit scores; requires a minimum 3.5% down payment.

- VA Loan: For eligible military personnel and veterans; requires no down payment.

- USDA Loan: For rural property buyers; also offers no down payment.

Step 4: Get Pre-Approved for a Mortgage

A pre-approval is a lender’s conditional commitment for a specific loan amount. It’s based on an in-depth review of your finances and involves a credit check and proof of income and assets. This step is crucial, as it shows sellers you are a serious buyer and strengthens your offer.

Required Documents for Pre-Approval:

- Proof of income (pay stubs, tax returns).

- Proof of assets (bank statements, investment accounts).

- Employment verification.

- Personal identification (driver’s license, Social Security number).

Step 5: Start House Hunting

With a pre-approval letter in hand, you can begin searching for homes within your price range. Partner with a real estate agent to help navigate the market and guide you in making a strong offer when you find the right home.

Tips for House Hunting:

- Focus on homes within your budget to avoid overextending financially.

- Consider long-term needs, including location, size, and neighborhood amenities.

Step 6: Make an Offer on a Home

Once you find the perfect home, your agent will help you make an offer. This step may involve some negotiation on price, closing date, or contingencies. In a competitive market, consider including an earnest money deposit to show your commitment.

Step 7: Apply for a Mortgage

After your offer is accepted, it’s time to officially apply for a mortgage with your chosen lender. They will need additional documents and information to process your loan application fully.

Step 8: Loan Processing and Underwriting

During the underwriting phase, your lender will verify all information provided in your application, assess your risk level, and determine if they will approve the loan. This process may take a few weeks and could involve follow-up questions.

Common Underwriting Steps:

- Appraisal: An independent appraiser assesses the home’s value to ensure it matches the loan amount.

- Title Search: A title company checks for any issues with the home’s title, such as unpaid taxes or liens.

- Document Verification: The lender may request additional documents, such as recent bank statements or pay stubs.

Step 9: Receive a Loan Estimate and Compare Offers

If you are considering multiple lenders, they will each provide a Loan Estimate after you apply. This document outlines:

- Loan terms, including the interest rate and monthly payments.

- Estimated closing costs.

- Any fees or additional charges.

Compare estimates to choose the best offer and negotiate if needed.

Step 10: Lock in Your Interest Rate

Interest rates can fluctuate, so if rates are favorable, ask your lender to lock in the rate to avoid future increases. Rate locks typically last 30-60 days, and some lenders may charge a fee for this service.

Step 11: Review the Closing Disclosure

Three days before closing, your lender will provide a Closing Disclosure with final loan details. Review this document carefully, as it includes:

- The final loan amount.

- Monthly payment breakdown.

- Closing costs and fees.

Compare it with your Loan Estimate to ensure everything matches.

Step 12: Attend the Closing

On closing day, you will sign all necessary documents to finalize the mortgage and purchase the home. You’ll also pay any remaining costs, such as down payment and closing fees, typically using a certified check or wire transfer.

Typical Closing Costs:

- Loan Origination Fees: Covers lender processing costs.

- Title Insurance: Protects you and the lender against title issues.

- Appraisal Fees: Covers the cost of the home appraisal.

- Home Inspection Fees: May be required depending on the lender.

- Escrow Fees: May include property taxes and homeowners insurance.

Once everything is signed, you’ll receive the keys to your new home, completing the process!